Wind Power 2017 Statistics

In 2017, the global wind industry continued with installations above 50 GW. After five years of essentially flat markets from 2009-2013 due to the global financial crisis, installations crossed the 50 GW mark in 2014 mark, and have stayed over 50 GW for the last four years.

June 19, 2018. By Moulin

WIND ENERGY

Wind Power 2017 Statistics

Report from Global Wind Energy Council (GWEC)

In 2017, the global wind industry continued with installations above 50 GW. After five years of essentially flat markets from 2009-2013 due to the global financial crisis, installations crossed the 50 GW mark in 2014 mark, and have stayed over 50 GW for the last four years.

The global wind power market remainedabove 50 GW in 2017, with Europe,India and the offshore sector having recordyears. Chinese installations were down -19.66 GW - but the rest of the world madeup for most of that.

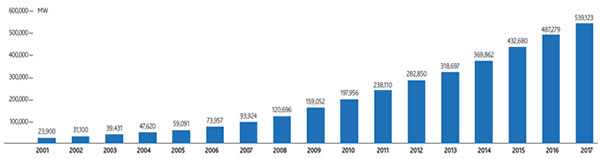

Total installations in 2017were 52,492 MW, bringing the global totalto 539,123 MW. The annual market was infact down 3.8% on 2016’s 54,642 MW; andthe cumulative total is up 11% over 2016’syear-end total of 487,279 MW.

The offshore segment had a record year with4,334 MW of installations, an 87% increaseon the 2016 market, bringing total globalinstallations to 18,814 MW, and representinga 30% increase in cumulative capacity.Offshore is still only about 8% of the globalannual market, and represents about 3.5% ofcumulative installed capacity, but it’s growingquickly.

Beyond the statistics, however, is the factthat wind power is in a rapid transitionto becoming a fully commercialized,unsubsidized technology; successfullycompeting in the marketplace against heavilysubsidized fossil and nuclear incumbents. Thetransition to fully commercial market-basedoperation has meant that the industry isgoing through a period of adjustment andconsolidation.

Total new investment in clean energyrose to US$ 333.5bn in 2017,up 3% over 2016, but still lower thanthe record investment of US$ 348.5bnin 2015.China alone accounted for 40% of totalinvestment with US$ 133bn; and the Asia Pacific region as a wholeinvested US$ 187 billion, over 57% of thetotal. Total investment in wind amounted to107 billion US$.

Cratering prices for both onshore and offshorewind continue to surprise. Markets in suchdiverse locations as Morocco, India, Mexicoand Canada range in the area of US$ 0.03/kWh, with a recent Mexican tender comingin with prices below US$ 0.02.

Meanwhile,offshore wind had its first ‘subsidy-free’ bidsin a tender in Germany last year, with tendersfor more than 1 GW of new offshore capacityreceiving no more than the wholesale price ofelectricity. Overall, offshore prices for projectsto be completed in the next 5 years or so arehalf of what they were for the last five years;and this trend is likely to continue.

Table 1: Global Installed Wind Power Capacity (Mw) – Regional Distribution

- Algeria, Cape Verde, Iran, Israel, Kenya, Libya, Mozambique, Nigeria

- Azerbaijan, Bangladesh, Sri Lanka

- Belarus, Faroe Islands, FYROM, Iceland, Liechtenstein, Norway, Russia, Switzerland, Serbia, Turkey, Ukraine

- Austria, Belgium, Bulgaria, Cyprus, Croatia, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, UK

- Caribbean: Aruba, Bonaire, Curacao, Cuba, Dominica, Guadalupe, Jamaica, Martinica, Granada, St. Kitts and Nevis

- Bolivia, Colombia, Ecuador, Guatemala, Nicaragua, Venezuela

Note: The stats includes a decommissioning of 648.8MW

Figure 1: Top 10 New Installed Capacity Jan-Dec 2017

Figure 2: Top 10 Cumulative Capacity Dec 2017

The technology continues to improve, openingup many areas for onshore wind developmentwhich were previously not commercial.More sophisticated power electronics, betterplanning and overall management havecontributed to increased reliability as wellas price reductions. Offshore, the size of themachines continues to boggle the mind, andthere will be 1X MW machines in the nottoo distant future. Indeed, on 1 March GEannounced its long-awaited next-gen design,the 12 MW Haliade-X, with a rotor diameterof 220 m, which could come into commercialoperation as early as 2021. It might not be toofar into the next decade before talking about the 2X machines for massive floatingoffshore installations in the deeper waters ofthe outer continental shelf.

Today, wind is the most competitively pricedtechnology in many if not most markets;and the emergence of wind/solar hybrids,more sophisticated grid management andincreasingly affordable storage begin to painta picture of what a fully commercial fossil-freepower sector will look like.

China, the largest overall market for windpower since 2009, retained the top spotin 2017. Installations in Asia once again ledglobal markets, with Europe in the secondspot, and North America in third.

Once again in 2017, as has been the case since2010 (except for 2012), the majority of windinstallations globally were outside the OECD.

By the end of 2017 there were 30 countrieswith more than 1,000 MW installed: 18 inEurope; 5 in Asia-Pacifi c (China, India, Japan,South Korea & Australia); 3 in North America(Canada, Mexico, US), 3 in Latin America(Brazil, Chile, Uruguay) and 1 in Africa (SouthAfrica).

Nine countries have more than 10,000 MWof installed capacity, including China, the US,Germany, India, Spain, the UK, France, Braziland Canada.

China will cross the 200,000 MW mark in2018, adding another milestone to its alreadyexceptional history of renewable energydevelopment since 2005.

Asia: Record Year For India

For the ninth year in a row, Asia was theworld’s largest regional market for newwind power development, with capacityadditions totalling 24.4 GW. China’s windmarket reached 188 GW by the end of 2017,reinforcing China’s lead in terms of cumulativeinstalled wind power capacity.

In terms of annual installations Chinamaintained its leadership position, althoughthe annual market dropped about 16%compared to last year, adding 19.7 GW of newcapacity.

In 2017, wind power generation reached305.7 TWh, an increase of more than 26%compared with 2016, and accounts for about4.75% of total Chinese power generation.

Curtailment on wind farms in China improvedsubstantially in 2017 according to theNational Energy Administration (NEA),averaging 12% across the country for the year,down from 17% in 2015.

On-going curtailment of electricitygeneration is a challenge for wind powerprojects. However, the NEA and State Grid areworking to solve the transmission bottlenecksand other grid issues, and the situation isimproving.

India had a record year in 2017, with4,148 MW being added to the grid, the firsttime the country has broken 4 GW in a singleyear, cementing its place as the second largestmarket in Asia, fifth in 2017 installations, andin solid fourth place in the global cumulativerankings. 2018 will be an off year as theswitch from the old regime to an auctioningsystem has left a ‘policy gap’.

However, 2019 and beyond are expectedto see a dramatic increase in the Indianmarket, as the government seeks to meetits targets of 175 GW of renewable capacityby 2022, with 60 GW of that coming fromwind. With cumulative installations standingat 32,848 MW at year-end 2017, that willmean an average of about 7 GW/year for thefour years following 2018. At the end of thisperiod, the beginnings of anoffshore wind sector emerging in the country must be seen.

As for the rest of Asia, it’s a long way downto third place, occupied by Pakistan with199 MW. Japan installed 177 MW forcumulative installations of 3,400 MW,while the wait will continue for the end to thestranglehold on the grid by the verticallyintegrated utility monopolies. South Koreaadded 106 MW, it is awaited to see anyeffect of the new government’s pledge todramatically increase the country’s shareof renewables in the power mix, with apresumed focus on the offshore sector.

Elsewhere, Mongolia commissioned itssecond 50 MW wind farm, Vietnam added38 MW, Thailand 24 MW, and Taiwan addedjust 10 MW as it focuses on its burgeoningoffshore sector, which will start to get builtout in the next few years.

.jpg)

Figure 3: Global Annual Installed Wind Capacity 2001-2017

Figure 4: Global Cumulative Installed Wind Capacity 2001-2017

North America: Strong growthcontinues in the US

The US is the second largest market in termsof total installed capacity after China. TheUS was also second in terms of the annualmarket, with 7,017 MW of new capacity addedin 2017, solidifying wind’s position as thenumber one source of renewable electricitygeneration capacity in the country. Althoughthe policy environment is relatively stableat the moment, the main driver for the windindustry is economics, with the price of powerfrom new wind installations having dropped67% since 2009.

Total installed capacity at the end of 2017 was89,077 MW, and the 250 TWh generated bythe

fleet represented 6.3% of total US powerproduction, up from 5.5% in 20164.

Texas leads all states with 22,637 MW ofwind power at the end of 2017, followed byOklahoma (7,495 MW), Iowa (7,308 MW),California (5,609 MW), Kansas (5,110 MW),Illinois (4,332 MW), Minnesota (3,699 MW),Oregon (3,213 MW), Colorado (3,104 MW)and Washington (3,075). Of the forty-oneUS states with commercial wind operations,18 have more than 1,000 MW. Iowa leads allstates in terms of penetration, getting 36% ofits electricity from wind power.

In Canada just 10 new projects totaling 341 MW of new wind capacity came onlinein 2017, Canada’s lowest total in many years.Canada’s total installations are just over12.2 GW, making it the ninth largest market interms of cumulative installations; delivering6% of the country’s electricity, enough tosupply 3 million Canadian homes.

The big news, however, was the result ofa tender in Alberta in December, where600 MW of new wind power was procuredat the very low price of CDN$ 37/MWh(€ 0.023/kWh; or $ 0.028/kWh), settinga new benchmark for a second auctionexpected in Alberta in 2018, as well as one inSaskatchewan.

There are now 295 wind farms made upof over 6,400 wind turbines operating inCanada, bringing economic development anddiversification to rural communities throughland lease income, property tax payments,ownership revenue and community benefitsagreements.

Mexico installed 478 MW of new capacityto reach a total of 4,005 MW by the end of2017, supplying about 4% of the country’selectricity. Mexico’s Energy Reform hasintroduced tendering for wind power andother renewables, the latest of which resultedin the record low price of US$ 0.017/kWh forone project.

In addition to wind farms procured throughthe tendering process, new regulations wereimplemented in 2017 which set out rules fordirect purchase of wind power by private/corporate consumers, giving developers analternative to the highly competitive auctions.

Expectations for 2018 are for a marketexceeding 1,000 MW for the first time, as thenewly tendered projects get built out, withinstallations expected to rapidly increase insubsequent years in pursuit of Mexico’s targetof 35% clean electricity by 2024.

Figure 5: Annual Installed Capacity By Region 2009-2017

Europe: New Records Abound

Both the EU and Europe as a whole setnew records in 2017, with new record highinstallations for the offshore sector, as well asin Germany, the UK, France, Belgium, Irelandand Croatia. 15.6 GW (16.8 GW in Europe)of new wind power capacity was installedin the EU during 2017; 3,148 MW of thatwas offshore. Annual onshore installationsincreased by 14%, while offshore installationsdoubled. Overall, the volume of newinstallations was up 25% on the 2016 market.

In 2017, Germany led all markets with6,581 MW (a 15% increase on 2016); 19%(1,247 MW) of Germany’s installed capacitywas offshore. The UK was second with 4,270 MW, five times more than installationsin 2016, with more than a third (1,680 MW)offshore. France came third with 1,694 MW(9% growth on the previous year).

Finland just missed setting a new record with535 MW, but new highs were set in Belgium(467 MW) and Ireland (426 MW). In total,17 countries saw some new installationslast year, down from 20 countries in 2016, reflecting a worrying concentration of themarket in fewer countries, with 80% of thetotal new installations in just three countries.

The new cumulative total at the end of2017 for the European Union is 168.7 GW(177.5 GW in Europe as a whole) of windpower capacity, 153 GW onshore and15.8 GW offshore, making wind energysecond only to gas in the European market.Germany retains the number one spot witha cumulative total of 56.1 GW, followed bySpain (23.2 GW), the UK (18.9 GW), France(13.8 GW) and Italy (9.5 GW). Sweden,Poland, Portugal and Denmark (and non-EUmember Turkey) have more than 5 GWinstalled. An additional seven countrieshave more than 1 GW: Austria, Belgium,Finland, Greece, Ireland, the Netherlands andRomania.

In total, wind energy generated about336 TWh in 2017, representing about11.6% of the EU’s electricity demand,supporting more than 260,000 jobs andattracting € 36.1 billion in investments.

As in many other parts of the world, theEuropean wind industry is in a period oftransition from the old support schemesto one based on competitive tendering ofone form or another. While this is a healthydevelopment for the sector as a whole, thereare a number of issues, key among them beingthe ‘policy gaps’ created in the transition,where developers and manufacturers lay idlewhile the industry and regulators adapt to thenew system.

For these reasons, as well as anticipateddips in the markets in Germany in the UK,EU installations are expected to be down abit in 2018, including in offshore. However,2019 will see a major rebound in offshoreinstallations, as a well as a major surge inthe Spanish market due to the buildout ofprojects awarded in 2017’s tenders.

Uncertainty remains about the post-2020environment for the climate and energyquestion in Europe, as EU institutionscontinue to struggle over the legislativepackage which will set the framework forEuropean energy policy over the next decade. However, final agreement on the package isexpected during the course of 2018. Whilethere has been some movement to ‘fix’ theEuropean emissions trading scheme, it is stillnot at a level which will drive investmentaway from carbon-intensive generation.

Latin America and the Caribbean:Brazil Continues To Lead

For the second year in a row, installationsin the Latin America and Caribbean regiondropped, from 3,078 MW in 2016, to2,578 MW in 2017, bringing cumulativecapacity up to 17,891 MW. However, it isexpected that the market will pick up again in2018 due to new installations in Argentina.

Despite the hiatus in tenders for new capacity,Brazil once again dominated the market,with its 2,022 MW accounting for more thanthree quarters of the installations in theregion. Brazil’s total at year end 2017 was12,763 MW, and it has subsequently passed13 GW. Although 1.4 GW was procured intenders late in 2017, there will be a slowdownin the coming years as the 2-year drought inauctions works its way through the system,although some of this may be made up by theprivate market.

Uruguay installed 295 MW in 2017, nearlycompleting the build-out of its wind sector– one more plant has come on line in 2018,and that will be it until overall circumstanceschange. With its cumulative capacity of1,505 MW of wind, Uruguay is now verynearly 100% renewable in the electricitysector with somewhere between 35 and 40%coming from wind.

Chile added 116 MW to bring total capacityup to 1,540 MW; and Costa Rica added59 MW for a total cumulative installedcapacity of 378 MW. Honduras added45 MW for a total of 225 MW, and Argentinaadded just 24 MW, but that is just the calmbefore the rapid buildout of its nearly 3 GWpipeline over the coming few years.

Overall prospects for the region going forwardare excellent. With Brazil’s economic recovery,the industry is back on track towards theminimum 2 GW/year market necessary tomaintain its supply chain. Argentina is set toboom in the coming years, and in addition tosubstantial build-out in Chile due to recenttenders, and some of the smaller CentralAmerican and Caribbean states, there arestirrings of a potentially substantial newmarket in Colombia.

Pacific

The region saw its total installed capacityrise to 5,193 MW last year, on the strength ofthe Australian market’s addition of 245 MW.Australia’s cumulative capacity now stands at4,557 MW.

New Zealand and the rest of the Pacific didnot add any new wind power capacity in 2017.

Africa and the Middle East

While there was a lot of activity in Africa andthe Middle East in 2017, the only installationswere in South Africa, bringing the regionaltotal up to 4,528 MW. South Africa installed618 MW of new capacity, for a cumulativetotal of 2,085 MW.

Much more diversification expected in 2018, with Kenya’s Lake Turkana projectfinally slated to come on line this year, andthe build-out of 2016’s tenders in Moroccoare expected to be largely completed duringthe course of the year. In addition, the first construction in Egypt since 2015 might be seen.Finally, of course, big thingsfrom Saudi Arabia’s new programme is expected to happen, but howmuch that will yield, and when, only time willtell.

The big news however, was the pledge by thenew South African government to honourthe tenders from 2015/2016. Having foughtoff a last-minute court challenge, on 4 Aprilthe new Minister of Energy presided over thesigning of the outstanding PPAs, including formore than 1.3 GW of wind energy. The return of the South African market to fullhealth in the coming year is expected.

At the end of 2017, over 99% of the region’stotal wind installations were spread across tencountries – South Africa, Morocco (787 MW),Egypt (810 MW), Tunisia (245 MW), Ethiopia(324 MW), Jordan (119 MW), Iran (91 MW),Cape Verde (24 MW), Kenya (26 MW), Algeria(10 MW) and Israel (6.25 MW).

2017: A Transition Year

In 2017, the global wind industry continuedwith installations above 50 GW. After five years of essentially flat markets from 2009-2013 due to the global financial crisis,installations crossed the 50 GW mark in 2014mark, and have stayed over 50 GW for thelast four years, with the anomalous Chinesemarket in 2015 pushing the total over 60 GW.Globally, cumulative installations passed500 GW in 2017, ending the year at about540 GW.

Wind power is increasingly the mostcompetitive way of adding new powergeneration to the grid in an increasing numberof markets, even competing against heavilysubsidized incumbents; and for the first timeit can be said that this now includes offshore,with ‘subsidy-free’ winning bids in Germany’soffshore auction in 2017, followed by a Dutch‘subsidy-free’ tender, which has just (20March) been awarded for two projects to bebuilt out by 2022.

Wind is a mature technology, with provenreliability and cost competitiveness. It is moreand more often the technology of choicefor utilities, and has also dominated thesurging corporate PPA market, where savvycompanies look to both provide a hedge against potentially wildly fluctuating fossilprices, and at the same time reduce theircarbon footprint – not to mention ‘greening’their image with increasingly vigilantconsumers.

Wind is making a rapid transition from atechnology reliant on ‘support’ in mostmarkets, to one where it stands on its owneconomically, even without any kind of financial benefit for the major rewards societyreaps from its deployment in terms of cleanair and carbon-dioxide emissions reductions.Hopefully getting there one will happen. But in themeantime, the industry will have to strugglewith shifting policy regimes and the inevitablegaps that accompany them and do the best totake it to the next level – annual installationsof 60, 70, or even 100 GW/year. This will benecessary to meet the Paris targets and securea sustainable energy future on a planet lefthabitable for succeeding generations.

2017 saw a concentration of installations in asmaller number of markets in Europe, Africa,and Latin America, reversing a trend for a diversification of markets that has marked theindustry’s growth over the last decade. Thatneeds to change, and there are solid signs thatit will in 2018.

There is a still an acute need around the worldfor new power generation, which is clean,affordable, indigenous, reliable and quickto install. Wind power is leading the chargein the transition away from fossil fuels; andcontinues to blow away the competition onprice, performance and reliability.

please contact: contact@energetica-india.net.