Renewable Energy Investments in 2017

The Indian numbers show investment oscillating in the $6-14 billion range since 2010 – still not reaching the sort of levels that would be required for that country to meet Prime Minister NarendraModi’s ambitious goals for 2022.

May 24, 2018. By Moulin

RENEWABLE ENERGY

Renewable Energy Investments in 2017

Report from The Frankfurt School-UNEP Collaborating Centre And Bloomberg New Energy Finance.

The Indian numbers show investment oscillating in the $6-14 billion range since 2010 – still not reaching the sort of levels that would be required for that country to meet Prime Minister NarendraModi’s ambitious goals for 2022.

Developed versus Developing Economies

Developing economies including the “big three” extended their lead over developed economies in 2017 in terms of investment in renewable energy. Excluding large hydro-electric projects of more than 50MW, emerging economies attracted $177.1 billion of new investment last year, less than a billion dollars short of the record figure of 2015, and up 20% from 2016. Meanwhile, developed economies saw investment slide 18% to $102.8 billion, their lowest aggregate since 2006.

Of course, these figures disguise the important reductions in costs per MW that have occurred in recent years – so, for instance, if the record investment figure for developed economies, of $197.1 billion in 2011, were to have been repeated last year, it would have bought a lot more gigawatts of renewables capacity than it did at the time. This cost reduction point makes the total last year for developing economies, and China in particular, all the more impressive.

Figure1 shows investment split into three categories of economy – developed, the ‘big three’ developing countries of China, India and Brazil, and other developing economies. It reveals that dollar commitments in these ‘other’ developing economies reached $33.5 billion last year, up 6%, but still below the record of $39.9 billion in 2015.

China, India and Brazil together saw dollars allocated to renewables hit $143.6 billion, their highest total ever and up 24% on 2016. China, as discussed below, was even more dominant in that ‘big three’ last year than previously.

Developed economy investment slipped 19% to $102.8 billion in 2017, the lowest figure since 2006 and only 37% of the global total. Much of this decline reflected the trend in Europe, where there were fewer big offshore wind financings in 2017 than in the previous two years, and both lower capital costs per MW and policy changes also had an impact.

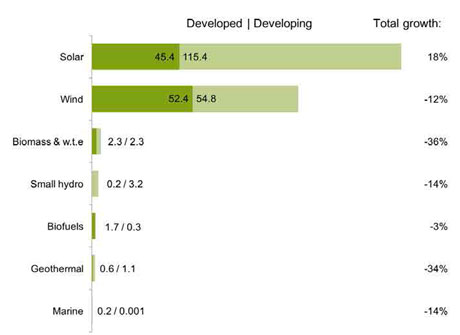

The gap between developing and developed economy investment last year was, in fact, a reflection of demand in the solar market. Figure2 shows that solar investment split $115.4 billion to $45.4 billion between the two main categories of economy, the developing country part being up 41% and the developed economy part being down 17%.

Wind was more evenly balanced, at $54.8 billion in developing economies, and $52.4 billion in developed countries. Those figures were down 4% and down 19% respectively in 2017 compared to 2016. Biomass and waste-to-energy investment was evenly split at $2.3 billion in both developing and developed economies, while small hydro outlays were, as usual, concentrated mainly in the developing world.

Figure1: Global New Investment In Renewable Energy: Split By Type Of Economy, 2004-2017

Note: New Investment Volume Adjusts For Re-Invested Equity. Total Values Include Estimates For Undisclosed Deals. Developed Volumes Are Based On Oecd Countries Excluding Mexico, Chile, And Turkey

Figure2. Global New Investment In Renewable Energy: Developed V Developing Countries, 2017, And Total Growth On 2016, $Bn

Note: Total values include estimates for undisclosed deals. New investment volume adjusts for re-invested equity. Includes estimates for small distributed capacity, corporate and government R&D. Developed volumes are based on OECD countries excluding Mexico, Chile, and Turkey.

Figure3: Global New Investment In Renewable Energy By Region, 2004-2016, $Bn

Note: New investment volume adjusts for re-invested equity. Total values include estimates for undisclosed deals

Main Centers

The different regional markets for renewable energy have showed contrasting trends over the years, as far as dollar investment is concerned, as highlighted in Figure3.

The China chart shows the powerful build-up of its activity in renewables, hitting records in 2015 and then again in 2017. The Europe graph reveals peaks in dollar investment around the turn of the decade, reflecting frantic spending on solar at relatively high costs per MW as feed-in tariffs in Spain, Germany and Italy lured developers and households. The U.S. chart is notable for sustaining a total in the range $33-49 billion per year since 2010, with a number of influences at work – including green stimulus programs, the rise and decline of the ‘yieldco’ and uncertainties over the future of the tax credits for wind and solar.

Brazil has seen relatively steady investment in recent years, after the end of the 2007-08 biofuel boom. The chart for Americas excluding the U.S. and Brazil, and the one for Middle East & Africa, both display increased dollar investment since 2010, but with ups and downs caused by the changing performance of particular countries such as Canada, Mexico, South Africa and Egypt. The graph for Asia-Pacific excluding China and India displays a hump in investment in 2013-15 due to the Japanese solar boom. The India chart shows investment oscillating in the $6-14 billion range since 2010 – still not reaching the sort of levels that would be required for that country to meet Prime Minister NarendraModi’s ambitious goals for 2022.

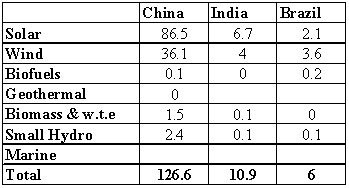

Figure4 underlines the dominance of China in 2017’s renewable energy investment, accounting for $126.6 billion out of the global total of $279.8 billion – equivalent to a record 45%. Its preponderance is equally striking in Figure5, which shows the top 10 investing countries last year. The sections below will describe developments in particular countries, but it is worth noting that two countries from 2016’s top 10 do not appear in the equivalent for 2017 (France and Belgium), and two other countries entered the list (Mexico and Sweden).

Figure4: Global New Investment In Renewable Energy By Region, 2017, $Bn

Note: New investment volume adjusts for re-invested equity. Total values include estimates for undisclosed deals

Figure5: New Investment in Renewable Energy by Top 10 Counties and Asset Class, 2017,

and Growth on 2016, $Bn

Note: Top 10 countries. *Asset finance volume adjusts for re-invested equity. Includes corporate and government R&D

Developed Economies

The U.S. has seen over the years a rich mix of different types of renewable energy investment. It is usually the largest location for venture capital and private equity funding of specialist green energy firms, and it has also seen high levels of public markets investment and of corporate and government research and development. It has also been one of the world’s biggest markets for small-scale solar development, and for utility-scale renewable energy projects.

This heterogeneity was again the case in 2017, as Table1 shows. Asset finance was the largest single component of U.S. investment, at $29.3 billion out of the $40.5 billion total, but small distributed capacity (rooftop and other solar systems of less than 1MW) also attracted large sums – $8.9 billion last year. The other elements – corporate and government R&D, VC/PE and public markets investment – were each around the $1 billion mark.

Of these, public markets investment was perhaps the most noteworthy at just $1 billion, since it has hit much higher levels in earlier years (for instance, $8.9 billion in 2015, at the peak of the boom in ‘yieldcos’, or publicly quoted companies owning operating-stage renewable energy projects). There is further discussion of the yieldco boom and decline in Chapter 6 on Public Markets.

As far as asset finance and small-scale projects were concerned in the U.S. in 2017, the dominant influence was the continuing availability of the Production Tax Credit for wind, and Investment Tax Credit for solar. These programs, providing tax incentives for investment in these technologies, were extended for five years by Congress in late 2015, and so still have a few years to run. Their existence enabled some developers to move ahead with substantial projects.

Table1: Renewable Energy investment in the U.S by sector & type, 2017, $Bn

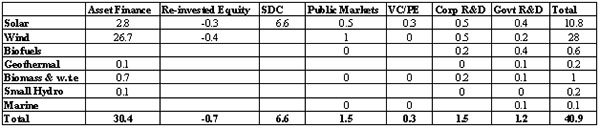

Table2: Renewable Energy investment in Europe by sector & type, 2017, $Bn

Small-scale solar investment in the U.S. slipped from $10.1 billion in 2016 to $8.9 billion in 2017. In part, this was due to declining system prices, but there was also restructuring in the market, with the largest supplier of residential panels, SolarCity, slowing down its activity significantly ahead of, and after, its takeover by Tesla.

Table2 shows the breakdown in investment for Europe in 2017, where the total finished up at $40.9 billion, down a third on the previous year. Corporate and government R&D, venture capital and private equity investment together amounted to $3 billion, steady with 2016, so the reasons for the fall were concentrated in the other investment categories: public markets, small distributed capacity and asset finance.

Public markets equity raising dropped 55% to $1.6 billion. There were issues by the quoted project fund Greencoat UK Wind and its Irish sister company Greencoat Renewables, worth $447 million and $314 million respectively, but there was nothing to rival Innogy’s $2.3 billion initial public offering in 2016. Small-scale project investment, meanwhile, slipped from $8.5 billion in 2016 to $6.6 billion in 2017, partly due to lower system costs and partly to a fall of more than half in U.K. spending, as subsidy support for small solar was cut sharply.

The big impetus, however, for lower European investment came from asset finance, which slid 38% to $30.4 billion last year. This was almost exactly accounted for by big falls in commitments in Germany and, in particular, the U.K. The latter saw just one big offshore wind project financed in 2017 (Hornsea 2, at $4.8 billion), and just one sizeable onshore wind farm reaching the same stage (the Banks portfolio, at $480 million). This reflected the closing of subsidy programs for onshore wind, biomass and solar, and a big gap between auctions for offshore wind. In 2016, the U.K. had four multibillion-dollar offshore wind financings, plus a string of biomass and onshore wind deals in the hundreds of millions of dollars.

German investment fell less steeply than that in the U.K., with four offshore wind projects financed, led by Hohe See, at 497MW and $1.9 billion, and a long list of medium-sized onshore wind projects worth between $10 million and $100 million. Germany is shifting to auctions for all technologies, and away from feed-in tariffs, and this created some uncertainty during 2017. The last auction in 2017 for onshore wind featured specific rules8 that resulted in almost all capacity being awarded to projects set up by local citizens.

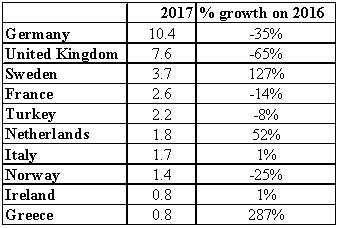

Table3 shows the extent of the reverses in overall investment for Europe’s two biggest markets, but also reveals that there were pockets of strength elsewhere in 2017, with Sweden seeing a 127% jump in investment to $3.7 billion on the back of several big onshore wind financings that were backed by corporate power purchasing agreements (see Chapter 4). Greece enjoyed a 287% boost to $760 million, helped by Enel’s decision to proceed with its 154MWKafireas wind farm. Hungary was another, and unfamiliar, bright spot, seeing investment jump from very little in 2016 to $649 million, on the back of a spurt in solar development.

Table3: Renewable Energy Investment in Europe by country, 2017, $Bnand change on 2016

Note: Top 10 countries. Total values include estimates for undisclosed deals

France’s investment in renewable energy dipped 14% to $2.6 billion in 2017. There was the $318 million financing of the 180MW ValecoMirova solar and wind portfolio, and a string of smallish projects funded in onshore wind, but a lack of other big or even medium-sized deals. The new government of President Emmanuel Macron has published plans to “liberate renewables”, with shorter permitting periods for projects. These, together with financing for the first conventional and floating offshore wind projects, may push investment upwards in the years ahead.

Netherlands was the location for one of the biggest ever onshore wind repowering deals. Vattenfall took final investment decision on the first stage (180MW and $236 million) of repowering the Wieringermeer project, removing old turbines and replacing them with new ones nearly three times as powerful.

China, India, Brazil

The sector detail of China’s $126.6 billion aggregate by sector is shown in Table5. What is clear is the dominance of solar, at $86.5 billion (up 58% year-on-year and the highest ever), far ahead of wind at $36.1 billion (down 6%), small hydro down 7% at $2.4 billion and biomass and waste-to-energy also down 7% at $1.5 billion.

Table5: Renewable Energy investment in China, India and Brazil by sector, 2016, $Bn

The spectacular build-out of 53GW of solar took place despite worries over a growing subsidy burden and worsening power curtailment. China’s regulators, under pressure from the industry, were slow to curb build of utility-scale projects outside allocated government quotas. Developers of these projects are crossing their fingers that they will be allocated subsidy in future years.

In addition, the cost of solar continues to fall in China, and more projects are being deployed on rooftops, in industrial parks or at other distributed locations. These systems are not limited by the government quota. Large energy consumers in China are now installing solar panels to meet their own demand, with a minimal premium subsidy. A breakdown of China’s solar surge in 2017 reveals that $19.6 billion of the investment took the form of systems of less than 1MW, against $64.9 billion for utility-scale arrays of more than 1MW.9 Many of the latter, however, were distribution-grid-connected rather than transmission-grid-connected, in other words local projects, often ground-mounted or on industrial rooftops.

However, there were also many Chinese solar projects financed in 2017 that were in the first rank globally in terms of size: for instance, the 540MW Jiangxi Municipal Poverty Alleviation plant, at an estimated $653 million, and the Huanghe Hydropower Hainan Gonghe installation, at about $605 million. And there were three solar thermal plants reaching final investment decision, including the 100MW China Three Gorges JiuquanJinta Molten Salt Tower, at $420 million.

In wind, offshore was particularly prominent in 2017, with the go-ahead for 13 projects worth between $600 million and $1.2 billion, led by the 400MW CGNWP YangjiangNanpengdao array. It was a record year by far for offshore wind asset finance in China, at $10.8 billion, up 180%.

Meanwhile, onshore wind’s $24.6 billion of asset finance in 2017 represented that sub-sector’s lowest dollar figure since 2008, and down 28% from 2016. Worries about curtailment and declining feed-in tariff rates contributed to the slowdown, but China remained the biggest onshore wind market in terms of installations, with 20GW added last year, down from 22GW in 2016 and a record 29GW in 2015. Many of the new onshore wind financings were medium-sized in scale, but there were also some stretching over much larger sites, such as the 400MW CR Power NeihuangRunfeng project, at an estimated $451 million.

India came fourth in the world rankings by country for renewable energy investment last year, at $10.9 billion, down 20%. As Table5 highlights, solar took the biggest share, at $6.7 billion, with wind at $4 billion. These lead sectors were up 3%, and down 41%, in dollar terms respectively. Solar activity was held back by an unexpected rise in PV module prices in local currency terms, due to a sudden reduction in the oversupply of imported Chinese units, exacerbated by the imposition of a 7.5% import duty on modules, and a local goods and service tax on panels. There was also a slowing in the pace of solar auctions around India.

In the medium term, PV installations look set to increase sharply, as India seeks to hit its ambitious target of 100GW of solar by 2022. However, that acceleration did not materialize in 2017. There were, nevertheless, several projects financed that rivalled in size anything financed in China last year – including the APPGCL Andhra Pradesh PV park, at 500MW and an estimated $400 million.

The third of the ‘big three’, Brazil, attracted $6 billion of renewable energy investment in 2017, up 8% on the previous year but still far below the peak total of $11.5 billion in 2008, when the biofuel boom in that country was still in full swing. Last year, as Table5 shows, activity was mainly concentrated in wind, at $3.6 billion, and solar at $2.1 billion. The former was down 18% on 2016 levels, but the latter was up a spectacular 204% as projects that won power purchase agreements in prior-year auctions secured financing.

The Brazilian market has been affected by political and economic uncertainty in recent years, and specifically by the cancellation of a renewable energy auction at the end of 2016. Projects that went ahead in 2017, such as the 216MW Rio Energy Serra da Babilonia wind farm and the 184MW Pirapora 1 PV portfolio, at $479 million and $350 million respectively, were winners in prior-year auctions and had deadlines to start delivering power. In biofuels, the imposition of duties on U.S. imports and a faltering of domestic demand combined to keep investors in cautious mood.

Source: “Global Trends In Renewable Energy Investment 2018 -- Released By UN Environment.” The Frankfurt School-UNEP Collaborating Centre And Bloomberg New Energy Finance.

please contact: contact@energetica-india.net.