Investment Trends

Total Corporate Funding In The Solar Sector Comes To $2 Billion In Q1 2018. Battery Storage companies secured $714 million; Smart Grid companies brought in $422 million; and Energy Efficiency companies received $384 million.

May 24, 2018. By Moulin

RENEWABLE ENERGY

Investment Trends

Mercom Report

Total Corporate Funding In The Solar Sector Comes To $2 Billion In Q1 2018. Battery Storage companies secured $714 million; Smart Grid companies brought in $422 million; and Energy Efficiency companies received $384 million.

Solar Funding

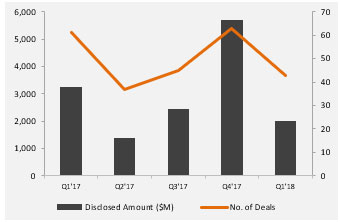

Total corporate funding (including venture capital funding, public market, and debt financing) into the solar sector in Q1 2018 fell 65 percent quarter-over-quarter (QoQ) to $2 billion from the $5.7 billion raised in Q4 2017. Year-over-year (YoY), Q1 2018 funding was 38 percent lower than the $3.2 billion raised in Q1 2017.

Graph1: Solar Corporate Funding Q1 2017-Q1 2018

After a strong fourth quarter in 2017, financial activity slowed again in Q1 2018 to the post-tariff announcement levels of last year as uncertainties and a lack of clarity in the markets took a toll on investments. The bright spot during Q1 was a record-high number of solar project acquisitions, proving that solar power generation is a sought-after asset class.

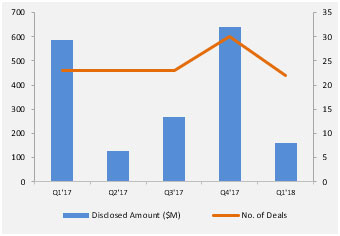

Global VC funding (venture capital, private equity, and corporate venture capital) for the solar sector fell 75 percent QoQ to $161 million in 22 deals compared to the $639 million raised in 30 deals in Q4 2017. The amount raised was also lower YoY compared to the $588 million raised in 23 deals in Q1 2017.

The majority of the VC funding raised in Q1 2018 went to solar downstream companies with $124.5 million in 18 deals.

Graph2: Solar VC Funding Q1 2017-Q1 2018

The top VC deals in descending order included: $55 million raised by Off Grid Electric, $25 million raised by d.light design, $23 million secured by Solaria Corporation, $12.5 million raised by Renewable Properties, $11 million raised by Kiran Energy Solar, and M-KOPA’s $10 million deal. A total of 30 VC investors participated in solar funding in Q1 2018.

Solar public market financing came to $103 million in four deals in Q1 2018, a steep decline QoQ from the $657 million raised in 10 deals in Q4 2017. It was also significantly lower YoY than Q1 2017 when $461 million was raised in 13 deals. Sky Energy had the only solar IPO in Q1 2018.

Announced debt financing totaled $1.8 billion in 17 deals during the first quarter of 2018. In a QoQ comparison, 23 deals were announced in Q4 2017 for a total of $4.4 billion. YoY, $2.2 billion was raised in 25 deals in Q1 2017. Most of the debt raised in Q1 2018 was by solar downstream companies.

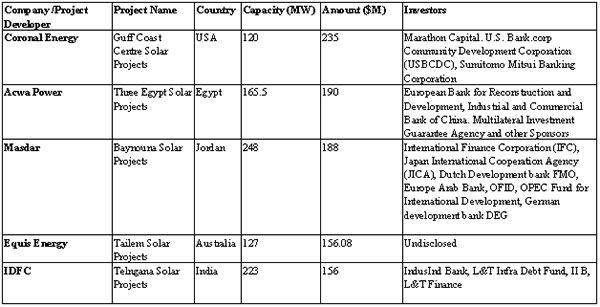

Large-scale project funding announced in Q1 2018 totaled $2.7 billion in 58 deals, down from $3.7 billion in 49 deals announced in Q4 2017. In a YoY comparison, $2.6 billion was raised in 33 deals in Q1 2017.

Table1:Solar Top 5 Announced Large-Scale Projects Funded By Dollar Amount in Q1 2018

Just one residential and commercial solar fund was announced in Q1 2018 (for $400 million), compared to $213 million raised in three funds in Q4 2017. During the same quarter of last year (Q1 2017), $630 million was raised in six funds.

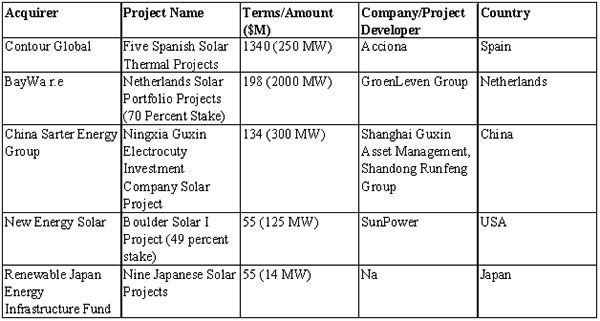

There were 19 solar M&A transactions announced in Q1 2018 compared to 13 transactions in Q4 2017 and 29 transactions in Q1 2017. Of the 19 total transactions in Q1 2018, 10 involved solar downstream companies.

There were 80 large-scale solar project acquisitions (16 disclosed for $1.9 billion) in Q1 2018 compared to 67 transactions (26 disclosed for $3.7 billion) in Q4 2017. In a YoY comparison, 49 transactions (18 disclosed for $1.9 billion) were announced Q1 2017. About 7.7 GW of large-scale solar projects were acquired in Q1 2018 compared to 5.8 GW acquired in Q4 2017. There were 20 investment firms and funds that acquired 24 projects in Q1 2018, totaling 1.2 GW, followed by utilities and IPPs where 13 companies picked up 30 projects totaling 1.3 GW. Twelve Project developers acquired 14 projects for 3.4 GW during the quarter.

Table2: Solar Top 5 Project Acquisitions by Dollar Amount in Q1 2018

Battery Storage Investment

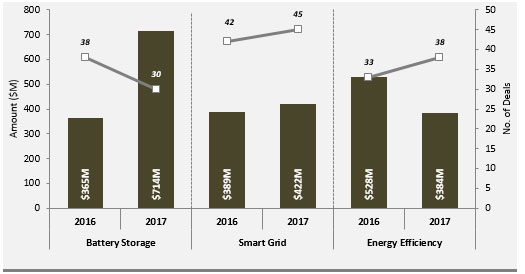

In 2017, a combined $1.5 billion was raised by Battery Storage, Smart Grid, and Energy Efficiency companies, an increase from the $1.3 billion raised in 2016

Graph1: Battery Storage, Smart Grid, and Energy Efficiency VC Funding 2016-2017

Battery Storage

In 2017, VC funding into Battery Storage companies almost doubled to $714 million raised in 30 deals from the $365 million raised in 38 deals in 2016, largely due to the $400 million Microvast deal. Total corporate funding, including debt and public market financing, rose to $890 million compared to $540 million in 2016.

Energy Storage Downstream companies received the most funding with $68 million followed by Lithium-based Battery companies with $65 million.

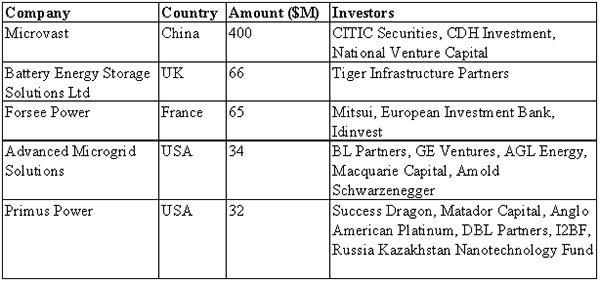

The top VC funded companies included: Microvast Power Systems with $400 million, Battery Energy Storage Solutions (BESS) with $66 million, Forsee Power brought in $65 million, Advanced Microgrid Solutions (AMS) raised $34 million, and Primus Power raised $32 million.

Table 3: Battery Storage Top 5 VC Funded Companies in 2017

Eighty-six VC investors participated inBattery Storage deals in 2017 compared to 62 in 2016.

In 2017, announced debt and public market financing for Battery Storage companies remained steady at $177 million raised in 12 deals compared to $175 million generated by eight deals in 2016.

Three project funds totaling $446 million were announced in the Battery Storage category in 2017, compared to $820 million raised in 2016 in seven deals.

Nine Battery Storage project funding deals were announced in 2017 totaling nearly $2.1 billion. By comparison, just $33 million was raised in four deals in 2016.

There were six M&A transactions in the Battery Storage category in 2017, of which only two disclosed transaction amounts. In 2016 there were 11 M&A transactions, three of which disclosed transaction amounts.

Smart Grid

VC funding in the Smart Grid sector rose to $422 million in 45 deals in 2017, compared to $389 million raised in 42 deals in 2016. Total corporate funding, including debt and public market financing, came to $1.2 billion compared to $613 million in 2016.

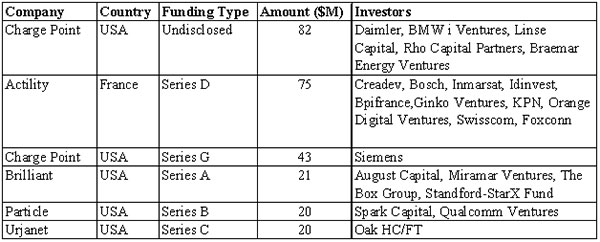

The top VC funded companies in 2017 were ChargePoint, which brought in $82 million and $43 million in two separate deals, Actility which received $75 million, Brilliant which secured $21 million, and Particle and Urjanet each raising $20 million.

Table 4: Smart Grid Top VC Funded Companied in 2017

Eighty-eight investors funded Smart Grid companies in 2017, compared to 82 in 2016. Top VC investors in 2017 included: ABB Technology Ventures, Braemar Energy Ventures, Chrysalix Venture Capital, Clean Energy Finance Corporation, Energy Impact Partners, EnerTech Capital, GE Ventures, innogy, National Grid, Obvious Ventures, and Siemens.

Smart Charging of plug-in hybrid electric vehicle (PHEV), vehicle-to-grid (V2G) companies, had the largest share of VC funding in 2017 with $155 million in 10 deals, followed by Demand Response companies with $94 million in four deals.

In 2017, five debt and public market financing deals totaling $774 million were announced, compared to $224 million raised in five deals in 2016. There were no IPOs announced for Smart Grid companies in 2017.

There were 27 M&A transactions recorded in the Smart Grid sector (just seven of these deals disclosed transaction amounts) in 2017 totaling $2.5 billion. In 2016 there were 15 transactions (four disclosed) for $2.4 billion. The top disclosed transaction was the $1.1 billion acquisition of Aclara by Hubbell.

Efficiency

VC funding for the Energy Efficiency sector fell to $384 million in 38 deals in 2017 compared to $528 million in 33 deals in 2016. Total corporate funding, including debt and public market financing, was $3.3 billion, compared to $3.8 billion in 2016.

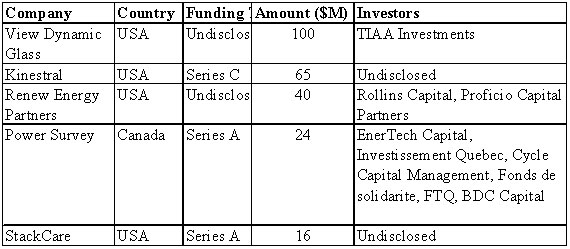

The top VC funded companies were View, which raised $100 million, followed by Kinestral Technologies with $65 million, RENEW Energy Partners with $40 million, Power Survey and Equipment brought in $24 million, and Stack Lighting with $16 million.

Table 5: Efficiency Top 5 VC Funded Companied in 2017

Efficient Home/Building companies captured the most funding with $172 million in five deals in 2017. A total of 51 investors participated in funding deals in 2017 compared to 72 investors in 2016. Energy Impact Partners was the most active investor in 2017.

In 2017, debt and public market financing announced by Energy Efficiency companies fell to $2.9 billion in 16 deals compared to the $3.2 billion raised in 16 deals in 2016. 2017 saw seven Property Accessed Clean Energy (PACE) financing deals bring in more than $1.6 billion compared to 12 deals that brought in $2.3 billion in 2016.

There were two securitization deals in 2017 for nearly $581 million compared to nine securitization deals for $1.8 billion in 2016. Securitization deals have now exceeded $4.5 billion in 24 deals since 2014.

M&A activity for the Efficiency sector in 2017 dropped to 10 transactions, three of which disclosed transaction amounts. In 2016, there were 14 M&A transactions with five that disclosed transaction amounts.

The largest disclosed transaction was the $526 million acquisition of LEDvance by a Chinese consortium consisting of IDG Capital, MLS, and Yiwu.

please contact: contact@energetica-india.net.