Cheap Renewables

As renewable capacity increases, economies of scale kick in and prices fall further, compounded by technological improvements, availability of cheaper financing, and ambitious targets by governments with clear energy policies. Records tumble, one after the other. Last year, for instance, saw record low solar costs broken not once, but four times and over a short period of time, raising questions as to whether it is realistic to expect this remarkable trend to continue.

May 22, 2018. By Moulin

RENEWABLE ENERGY

Cheap Renewables

Institute for Energy Economics and Financial Analysis (IEEFA).

As renewable capacity increases, economies of scale kick in and prices fall further, compounded by technological improvements, availability of cheaper financing, and ambitious targets by governments with clear energy policies. Records tumble, one after the other. Last year, for instance, saw record low solar costs broken not once, but four times and over a short period of time, raising questions as to whether it is realistic to expect this remarkable trend to continue.

Briefing Note

Records were smashed in the energy sector in 2017, with a dramatic drop in solar and wind prices driving a global transformation across the global electricity sector.

Installations of wind and solar totaled almost 155 gigawatts (GW) last year, more than the entire installed power capacity in the U.K., meaning that renewables continue to far outpace coal-fired power plant development.

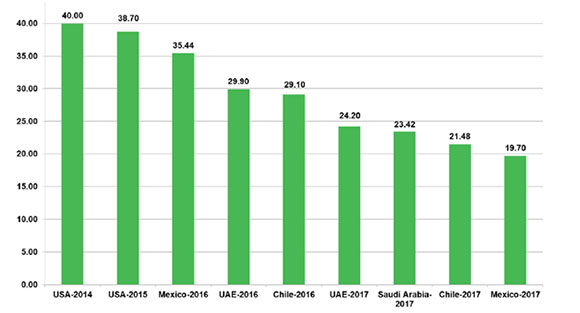

Among the good news for consumers is that the lowest bids for solar dropped a remarkable 50% from records set in 2014 and 2015. Graph1 illustrates the ongoing record breaking down-trend (deflation) of solar power prices.

Graph 1: Global Solar Deflation (US $/Mwh)

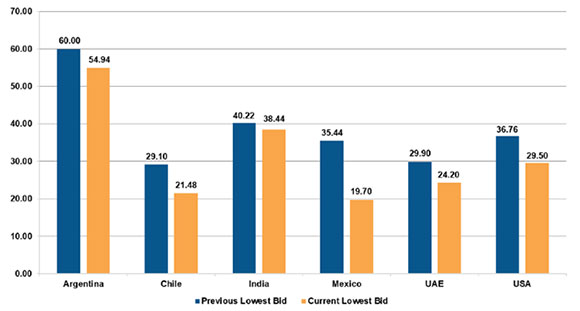

Graph2 provides a within-country, local comparison between the last two lowest solar bids, in 2016 and 107. Country-specific factors in pricing, taxes, inflation-indexation, subsidies and policies prevent a clean inter-country comparison. However, the general trend is common to all, driven by ongoing technology improvements plus gains in economies of scale in all areas of raw materials, manufacturing, procurement and construction, and debt and equity financing.

Graph2: Solar Power Bids (US $/Mwh) Deflationary Trend (Previous vs. Current Lowest Bids 2016/17)

The transformation under way creates momentum for a rapid shift from fossil fuels by large utilities such as ENGIE in France, NTPC of India and NextEra in the US.

Italy’s ENEL, which only founded its green power division in 2008, now derives half of its generating capacity from its 39.4 GW of renewable assets globally.

And as renewable capacity increases, economies of scale kick in and prices fall further, compounded by technological improvements, availability of cheaper financing, and ambitious targets by governments with clear energy policies.

Records tumble, one after the other. Last year, for instance, saw record low solar costs broken not once, but four times and over a short period of time, raising questions as to whether it is realistic to expect this remarkable trend to continue.

This momentum is not just gaining in a few sun-drenched markets like Saudi Arabia. Today it is feeding technology-driven transition worldwide. In 2017, a record 75 GW of solar power capacity was added by the three largest thermal power-consuming nations: China (53 GW), the U.S. (12GW), and India (10GW).

These are big numbers. To put them in perspective, 75GW is greater than the total of all electricity power capacity of Australia or Indonesia.

While solar is grabbing global headlines, the prize for the world’s cheapest energy went elsewhere in 2017, to wind.

In November 2017, Italy’s Enel Green Power made the lowest-ever bid for electricity generation in a Mexican wind auction.

While wind’s recent cost decline has not been as universally stellar as solar’s, mostly because wind is a more mature sector, its price downtrend in 2016 and 2017 has been precipitous, particularly in countries with the most favorable conditions and policies.

In the latest wind auction in India, the winning bid came slightly below the lowest solar power bid of $38.45/MWh for the Bhadla Solar park in December 2017. Even though it was just a 6% decline from the previous lowest wind tariff, deflation since the introduction of transparent reverse auctions in 2017 is in the order of 50% (Rs2.43/kWh vs Rs4.5-5.00/kWh).

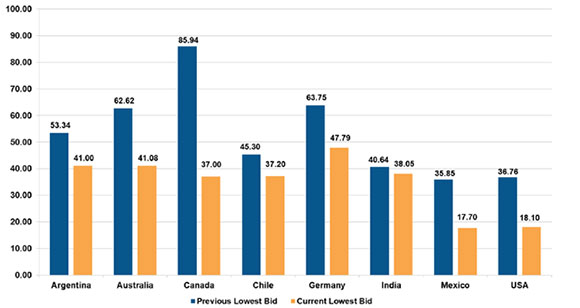

The largest and the most unexpected decline, of 60%, was reported at the end of 2017 in Alberta, Canada at US$37/MWh. Likewise Xcel Energy’s December 2017 auction saw wind power in Colorado hit a new U.S. record low of just US$18.10/MWh, down 50 percent.

The U.S. company Nextera Energy, one of the most forward looking and successful utilities globally reported yet another successive record annual result in 2017 after he company installing a world record 2.15GW of renewables in 2017, Nextera CEO Jim explained some of what is helping NextEra prosper: “Over the past year, an approximate 30% reduction in turbine costs has been noticed. Through the end of the decade, another 10% decline per year on average is expected.”

Nextera projects that by the mid-2020s renewables will produce electricity cheaper than existing thermal power plants in America.

The Institute for Energy Economics and Financial Analysis (IEEFA) sees India, well of its start tow electricity generation, getting there by 2020.

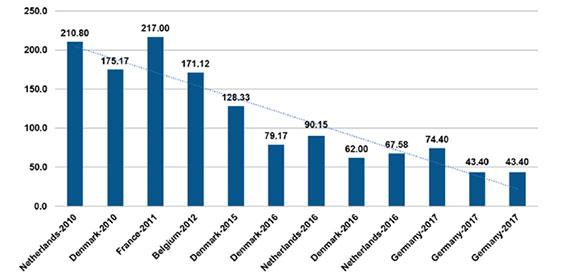

Pricing trends in the offshore wind markets of Germany and the U.K. surprised everyone in 2017, with a series of outstanding auction results highlighting cost deflation trends across one or two that were expected to take a decade to materialize.

The scale of offshore wind has moved from below 3MW per turbine at the start of this decade to a planned 12-15MW per turbine proposed for installation by 2024/25, a fivefold increase in 10 years. And offshore wind has moved from below 3MW per turbine at the start of this decade to a planned 12-15MW per turbine proposed for installation by 2024/25, another fivefold increase. Investor-required rates of return have likewise decreased materially as the technology involved becomes more widely accepted and construction procedures de-risked.

IEEFA notes that Japan, India, South Korea, Taiwan, France and the U.S. are all now implementing plans for a rapid scaling up of new renewable energy technology after a decade of pre-commercial viability investment by Germany, Denmark and the U.K.

A growing number of governments have decided to diverge from the legacy fossil fuel power generation, and this rampant, deflationary trend around renewable will give economic credence to this decision. New investment decisions favor renewables because of their commercial merit, their lower externalities, their diversity of supply they bring to the grid, and their nonexistent a stranded-asset risks of the sort that plague thermal power plants which, once built, generally have a 40-50 year lifespan.

Leadership in this trend is becoming more geographically widespread, with India, Mexico, Chile, Argentina, Australia, Canada and the UAE joining the more traditional global frontrunners of China, America, Germany, Denmark and the U.K.

For countries still considering future electricity generation needs in terms of cost, rapidly-deployed renewables increasingly offer the best option. Even in mature economies, replacing fossil fuel imports with renewables is increasingly the answer. with Taiwan, South Korea and others countries like them having started the shift in 2017.

Renewables are not yet the least costly option in every market, but the pace of change around demonstrates that a tipping point toward a new energy economy coming, and fast.

Graph 3: Onshore Wind Power Bids US $/MWh Deflationary Trend (Previous vs. Current Lowest Bids 2016/17)

Graph4: Europe’s Offshore Wind Power Tariff ($/MWh) 2010/2017

Note 1: Tariffs are converted to USD based on conversion rates on January 30, 2018.

Note 2: Tariffs for the UK include grid connection costs, whereas European tariffs exclude grid connection charges

Source: “Briefing Note: Cheap Renewables Are Transforming Global Electricity Business Record Uptake and Record-Low Bid For Solar and Wind.” Tim Buckley, Director of Energy Finance Studies, Kashish Shah, Research Associate, Institute for Energy Economics and Financial Analysis (IEEFA).

please contact: contact@energetica-india.net.