Diesel price continue to rise in India

ICRA: Diesel retail price approaching market-linked pricing - a credit positive for the Indian petroleum sector

September 03, 2014. By Moulin

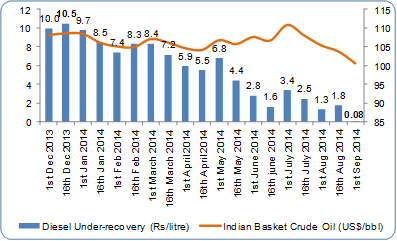

Oil Marketing Companies (OMCs) increased the retail price of subsidised diesel by ~50 paisa per litre on August 30, 2014 in line with the past trend, which started in January 2013 when the Government of India (GoI) had decided to increase diesel prices in small doses every month. On the same day, the bulk diesel prices, which are market-linked have been reduced by Rs. 1.3 per litre. ICRA Research notes the current under-recovery on subsidised diesel has become almost nil (at 8 paisa per litre) post the recent increase, based on previous pricing fortnight level of crude oil prices and foreign exchange rate. The fall in market-linked diesel prices follow the recent softening in crude oil prices along with appreciation in INR against US$ over the last one month. Even though the retail prices of diesel have reached closer to the market-determined prices, the decision on deregulation of prices is yet to be taken. There is lack of clarity whether the GoI will completely deregulate the prices by authorising the OMCs to revise the prices of diesel with market conditions or the retail price increase would be capped at ~50 paisa per litre per month even if there is sudden increase in crude oil price or depreciation in INR demanding steeper price hike. The decision on the same will be critical for the private retailers to restart their fuel stations as the GoI may continue to share under-recovery of only OMCs if it caps the price hike to only 50 paisa per litre per month.

Chart 1: Diesel under-recovery vs Crude oil prices

Source: PPAC; PIB Release and ICRA Research analysis

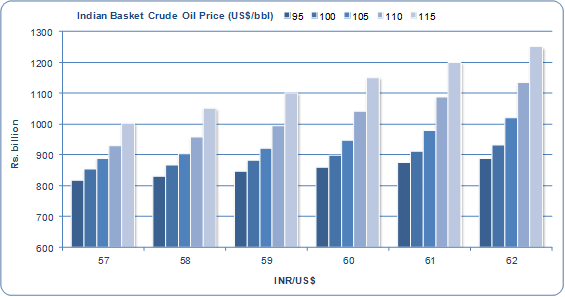

CRA Research had earlier projected the gross under-recoveries (GURs) to decrease to around Rs. ~1000 billion for FY15 from Rs. 1399 billion for FY14 considering average Indian basket crude oil price of US$ 108/bbl, INR-USD rate of 59.5, and Rs. 0.5/litre monthly rise in retail diesel prices. If the softened crude oil prices sustain for the rest of FY15, the fall in under-recoveries could be sharper to around Rs. 900 billion for FY15 (estimated at Indian Basket crude oil price of US$ 101/bbl and INR/US$ of 60.5). The under-recoveries on diesel are expected to reduce to almost one-fourth to Rs. ~150 billion in FY15 from Rs. 628 billion in FY14. The fall in gross under-recovery should lead to decrease in short-term debt levels and interest cost of OMCs; thereby resulting in improvement in their liquidity position. Besides, the fall in under-recoveries could also lead to decrease in the subsidy burden of the GoI as the government may retain large part of benefits of lower under-recoveries in order to meet its aggressive fiscal deficit reduction target for FY 15

please contact: contact@energetica-india.net.