Self-Reliance in Photovoltaic Technology

Though India has achieved more than 90 GW, overall control of supply, quality, and pricing lies elsewhere. The need of the hour is to focus right from polysilicon, wafer, ingot, materials, and other supporting ecosystems simultaneously.

October 07, 2025. By News Bureau

After the 1974 Oil Embargo, scientists worldwide developed non-conventional sources of energy, and Solar Photovoltaic (PV) emerged as a very promising alternative. The world has more than 1800 GW of solar PV installations, with China leading the world with a total of 890 GW as of early 2025. India stands at 90 GW.

Solar technology revolves around silicon, and the entire technology is the management of several contradicting technical alternatives in processes, materials, and structures. However, for any state to achieve self-sufficiency in making solar energy alternatives their preferred choice is not easy and straightforward. Knowing how to make the best cells and modules alone cannot lead any state to the path of self-reliance in fulfilling the energy needs of their society.

We need to understand various elements of the value chain of solar energy, including several ecosystems associated with it. In addition, the implementation and proper absorption of these technologies are very important. This paper tries to explain various aspects of this technology to attain the goal of self-reliance. Incidentally, the development of this sector benefits society by supporting other similar sectors to grow towards self-sufficiency as well.

Market Scenario of PV Technology

• Global Market Overview

Record Installations: In 2024, global solar PV installations reached approximately 592 gigawatts (GW), marking a 33 percent increase from 2023. This surge was primarily attributed to declining module prices and strong demand from emerging markets.

Investment Trends: The International Energy Agency (IEA) projected that investment in solar PV would exceed USD 500 billion in 2024, surpassing all other generation technologies combined. This growth is supported by significant investments in countries like China, India, and parts of Africa.

• Emerging Markets

Africa: Investment in solar energy in Africa has nearly doubled since 2020, with countries like South Africa and Kenya leading in deployment. Initiatives combining solar with battery storage are gaining momentum.

Southeast Asia: Nations such as Vietnam and Indonesia are rapidly adopting solar technologies, supported by favorable policies and declining costs. Vietnam has seen a significant increase in climate tech investments.

• Technological Advancements

The industry is witnessing innovations like bifacial modules, perovskite solar cells, and integrated storage solutions, enhancing efficiency and application versatility.

• Supply Chain Challenges

Despite technological progress, the industry faces challenges such as oversupply of modules, leading to price pressures and financial strain on manufacturers.

• Domestic Manufacturing Landscape

Policy Support: The Indian government has mandated that, from June 2026, clean energy projects must use solar PV modules made from locally produced cells. This policy aims to reduce reliance on Chinese imports and boost domestic manufacturing.

Installed Capacity: As of March 2024, India had approximately 25 GW of solar cell manufacturing capacity and 90 GW of module manufacturing capacity.

Despite the growth in domestic module capacity, India remains heavily reliant on imports for solar cells, with about 80 percent of its cell requirements met through imports, primarily from China.

Perovskite Solar Cells

Emerging technology with lab efficiencies exceeding 26 percent and tandem configurations reaching 33.9 percent. It has very good potential with TOPCON as tandem cells of 29–30 percent, improving stability (against moisture, UV, and heat) and scaling from lab to high-yield manufacturing. Advances in encapsulation and material composition are underway. Pilot lines are operational, with broader market entry expected by 2026–2028.

Bifacial Cells

Growing adoption due to lower costs and higher energy yield (capturing light from both sides). Market share projected to reach 30 percent by 2027.

All the above technologies are silicon wafer-based and have become the basic requirement of the PV roadmap; it is therefore important to understand the PV value chain.

Silicon Value Chain

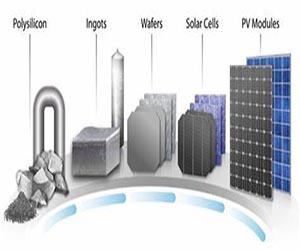

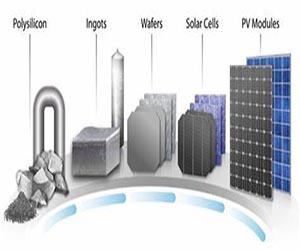

The above figure shows the entire value chain for manufacturing solar PV modules, a basic building block for harnessing solar power as electricity.

Presently, we are in a world where the strength of any state is directly connected with its maturity in developing and growing various technical capabilities. Though there is a world economic order to be maintained, needy states are highly dependent, and a lot of arm-twisting is done by way of controlling supplies and prices.

So, in order to be self-reliant in a given technology domain, e.g., solar in this case, any state prioritising solar as a key area for energy security must achieve total development of the value chain within a proper time frame. The associated ecosystem should also be developed simultaneously.

The solar photovoltaic (PV) value chain can be broadly divided into three sectors: upstream, midstream, and downstream.

Upstream

• Raw Material Extraction: This includes mining or extracting materials like silica, cadmium, and tellurium.

• Polysilicon Production: Polysilicon is produced from extracted silica through various processes.

• Ingot and Wafer Production: Polysilicon is melted and formed into ingots, which are then sliced into thin wafers.

Midstream

• Solar Cell Manufacturing: Wafers are processed to create solar cells.

• Module Assembly: Solar cells are connected, encapsulated, and framed to form solar modules.

Downstream:

• Balance-of-System Components: This includes inverters, racking systems, and other electrical components.

Current Trends and Future Directions (2025)

• High-Efficiency Cells: TOPCon and HJT are scaling commercially, with efficiencies approaching 26 percent. Perovskite-silicon tandem cells are nearing market readiness, targeting >30 percent efficiency.

• Sustainability: Focus on reducing carbon footprints, recycling PV modules, and replacing toxic materials (e.g., lead in perovskites).

• Bifacial and Flexible Modules: Bifacial panels, capturing light on both sides, are standard in large-scale projects. Flexible, lightweight panels are expanding into building-integrated PV (BIPV) and portable applications.

• Energy Storage Integration: PV systems increasingly pair with batteries (e.g., lithium-ion) to address intermittency, driven by falling storage costs.

• AI and IoT: Machine learning optimises manufacturing and system performance, while IoT enables real-time monitoring of solar farms.

• Emerging Tech: Quantum dot solar cells and organic PV are in early research stages, promising ultra-low-cost, flexible applications.

Self-Reliance in All Areas Related to PV

For any state to be self-reliant in the solar energy field, the following areas need to be attended to simultaneously:

• Development of technology and manufacturing capability across the entire value chain. Initially, manufacturing equipment can be imported, but the development of the following ecosystem must also be pursued.

• Equipment development capability for the entire value chain, whether reactors for polysilicon, pullers for ingots, slicers for wafering, thermal, chemical, and printing tools for cell manufacturing, module manufacturing equipment, and finally inverters and system-related equipment.

• For solar and semiconductors, purity is very important; therefore, the need for a high-purity chemicals, gases, and materials industry should also emerge as ecosystem support.

• A high degree of effort is required in continuous R&D to meet current and future international standards and also exceed them. This calls for several highly active research centers to work on processes, equipment, materials, and new developments using the latest AI techniques to bring the entire PV industry under proper control.

• A large pool of highly trained manpower is needed. For this, our academic institutions should impart relevant knowledge and experience.

• So far, India has attained some level of expertise in the area of solar cells, modules, and system development. Yet, these sectors remain dependent on equipment, infrastructure, and materials.

• It is important to have the simultaneous involvement and participation of the state in all the verticals of the silicon value chain, equipment, raw material development, infrastructure, and manpower development.

Conclusion

Though India has achieved more than 90 GW, overall control of supply, quality, and pricing lies elsewhere. In the absence of material, infrastructure, and a technology base, growth is missing. To overcome this, the state should take a leading role, as seen in India’s initiation of the PLI scheme across all verticals of the silicon value chain. However, results are currently seen only in the areas of cells and modules.

The need of the hour is to focus right from polysilicon, wafer, ingot, materials, and other supporting ecosystems simultaneously. Timing is of the essence, and initial investment can start paying off if everything—including equipment development and manpower development—is started at the same time.

To start with, initial equipment and technology can be imported, as they are available from many vendors. Manpower development should be undertaken at national research institutes and academic centers, with proper project definitions, financial support from the state, and close monitoring of progress with optimistic timelines.

Reward for achievement is another key factor. This approach should result in significant development toward self-reliance within a five-year time frame. The cascade effect will automatically spur developments in related sectors like semiconductors, displays, PCBs, and many other electronic industries.

- Vijay Kumar, COO, Zuvay Technologies Pvt. Ltd.

Solar technology revolves around silicon, and the entire technology is the management of several contradicting technical alternatives in processes, materials, and structures. However, for any state to achieve self-sufficiency in making solar energy alternatives their preferred choice is not easy and straightforward. Knowing how to make the best cells and modules alone cannot lead any state to the path of self-reliance in fulfilling the energy needs of their society.

We need to understand various elements of the value chain of solar energy, including several ecosystems associated with it. In addition, the implementation and proper absorption of these technologies are very important. This paper tries to explain various aspects of this technology to attain the goal of self-reliance. Incidentally, the development of this sector benefits society by supporting other similar sectors to grow towards self-sufficiency as well.

Market Scenario of PV Technology

• Global Market Overview

Record Installations: In 2024, global solar PV installations reached approximately 592 gigawatts (GW), marking a 33 percent increase from 2023. This surge was primarily attributed to declining module prices and strong demand from emerging markets.

Investment Trends: The International Energy Agency (IEA) projected that investment in solar PV would exceed USD 500 billion in 2024, surpassing all other generation technologies combined. This growth is supported by significant investments in countries like China, India, and parts of Africa.

• Emerging Markets

Africa: Investment in solar energy in Africa has nearly doubled since 2020, with countries like South Africa and Kenya leading in deployment. Initiatives combining solar with battery storage are gaining momentum.

Southeast Asia: Nations such as Vietnam and Indonesia are rapidly adopting solar technologies, supported by favorable policies and declining costs. Vietnam has seen a significant increase in climate tech investments.

• Technological Advancements

The industry is witnessing innovations like bifacial modules, perovskite solar cells, and integrated storage solutions, enhancing efficiency and application versatility.

• Supply Chain Challenges

Despite technological progress, the industry faces challenges such as oversupply of modules, leading to price pressures and financial strain on manufacturers.

• Domestic Manufacturing Landscape

Policy Support: The Indian government has mandated that, from June 2026, clean energy projects must use solar PV modules made from locally produced cells. This policy aims to reduce reliance on Chinese imports and boost domestic manufacturing.

Installed Capacity: As of March 2024, India had approximately 25 GW of solar cell manufacturing capacity and 90 GW of module manufacturing capacity.

Despite the growth in domestic module capacity, India remains heavily reliant on imports for solar cells, with about 80 percent of its cell requirements met through imports, primarily from China.

Perovskite Solar Cells

Emerging technology with lab efficiencies exceeding 26 percent and tandem configurations reaching 33.9 percent. It has very good potential with TOPCON as tandem cells of 29–30 percent, improving stability (against moisture, UV, and heat) and scaling from lab to high-yield manufacturing. Advances in encapsulation and material composition are underway. Pilot lines are operational, with broader market entry expected by 2026–2028.

Bifacial Cells

Growing adoption due to lower costs and higher energy yield (capturing light from both sides). Market share projected to reach 30 percent by 2027.

All the above technologies are silicon wafer-based and have become the basic requirement of the PV roadmap; it is therefore important to understand the PV value chain.

Silicon Value Chain

The above figure shows the entire value chain for manufacturing solar PV modules, a basic building block for harnessing solar power as electricity.

Presently, we are in a world where the strength of any state is directly connected with its maturity in developing and growing various technical capabilities. Though there is a world economic order to be maintained, needy states are highly dependent, and a lot of arm-twisting is done by way of controlling supplies and prices.

So, in order to be self-reliant in a given technology domain, e.g., solar in this case, any state prioritising solar as a key area for energy security must achieve total development of the value chain within a proper time frame. The associated ecosystem should also be developed simultaneously.

The solar photovoltaic (PV) value chain can be broadly divided into three sectors: upstream, midstream, and downstream.

Upstream

• Raw Material Extraction: This includes mining or extracting materials like silica, cadmium, and tellurium.

• Polysilicon Production: Polysilicon is produced from extracted silica through various processes.

• Ingot and Wafer Production: Polysilicon is melted and formed into ingots, which are then sliced into thin wafers.

Midstream

• Solar Cell Manufacturing: Wafers are processed to create solar cells.

• Module Assembly: Solar cells are connected, encapsulated, and framed to form solar modules.

Downstream:

• Balance-of-System Components: This includes inverters, racking systems, and other electrical components.

• High-Efficiency Cells: TOPCon and HJT are scaling commercially, with efficiencies approaching 26 percent. Perovskite-silicon tandem cells are nearing market readiness, targeting >30 percent efficiency.

• Sustainability: Focus on reducing carbon footprints, recycling PV modules, and replacing toxic materials (e.g., lead in perovskites).

• Bifacial and Flexible Modules: Bifacial panels, capturing light on both sides, are standard in large-scale projects. Flexible, lightweight panels are expanding into building-integrated PV (BIPV) and portable applications.

• Energy Storage Integration: PV systems increasingly pair with batteries (e.g., lithium-ion) to address intermittency, driven by falling storage costs.

• AI and IoT: Machine learning optimises manufacturing and system performance, while IoT enables real-time monitoring of solar farms.

• Emerging Tech: Quantum dot solar cells and organic PV are in early research stages, promising ultra-low-cost, flexible applications.

For any state to be self-reliant in the solar energy field, the following areas need to be attended to simultaneously:

• Development of technology and manufacturing capability across the entire value chain. Initially, manufacturing equipment can be imported, but the development of the following ecosystem must also be pursued.

• Equipment development capability for the entire value chain, whether reactors for polysilicon, pullers for ingots, slicers for wafering, thermal, chemical, and printing tools for cell manufacturing, module manufacturing equipment, and finally inverters and system-related equipment.

• For solar and semiconductors, purity is very important; therefore, the need for a high-purity chemicals, gases, and materials industry should also emerge as ecosystem support.

• A high degree of effort is required in continuous R&D to meet current and future international standards and also exceed them. This calls for several highly active research centers to work on processes, equipment, materials, and new developments using the latest AI techniques to bring the entire PV industry under proper control.

• A large pool of highly trained manpower is needed. For this, our academic institutions should impart relevant knowledge and experience.

• So far, India has attained some level of expertise in the area of solar cells, modules, and system development. Yet, these sectors remain dependent on equipment, infrastructure, and materials.

• It is important to have the simultaneous involvement and participation of the state in all the verticals of the silicon value chain, equipment, raw material development, infrastructure, and manpower development.

Though India has achieved more than 90 GW, overall control of supply, quality, and pricing lies elsewhere. In the absence of material, infrastructure, and a technology base, growth is missing. To overcome this, the state should take a leading role, as seen in India’s initiation of the PLI scheme across all verticals of the silicon value chain. However, results are currently seen only in the areas of cells and modules.

The need of the hour is to focus right from polysilicon, wafer, ingot, materials, and other supporting ecosystems simultaneously. Timing is of the essence, and initial investment can start paying off if everything—including equipment development and manpower development—is started at the same time.

To start with, initial equipment and technology can be imported, as they are available from many vendors. Manpower development should be undertaken at national research institutes and academic centers, with proper project definitions, financial support from the state, and close monitoring of progress with optimistic timelines.

Reward for achievement is another key factor. This approach should result in significant development toward self-reliance within a five-year time frame. The cascade effect will automatically spur developments in related sectors like semiconductors, displays, PCBs, and many other electronic industries.

- Vijay Kumar, COO, Zuvay Technologies Pvt. Ltd.

If you want to cooperate with us and would like to reuse some of our content,

please contact: contact@energetica-india.net.

please contact: contact@energetica-india.net.