Power Sector Investors’ Meet 2018

The articles touches on the important topics discussed during the Indian Power Sector Investors’ Meet 2018 in 1Q 2018 in Mumbai.

April 19, 2018. By Moulin

POWER SECTOR

Power Sector Investors’ Meet 2018

Energetica India

The articles touches on the important topics discussed during the Indian Power Sector Investors’ Meet 2018 in 1Q 2018 in Mumbai.

Indian Power Sector’s Socio Economic Trends

Rapid urbanization to drive energy demand

- IncreasedConsumptionwillboostmanufacturingforappliances.

- Strongdemandtopropelenergyintensiveindustriese.g.steelandcement.

Better utility-Consumer engagement

- Higher demand for products & services e.g. smart meters.

- Energy efficiency adoption to create new segments.

- New PPP ventures with utilities

Adoption of cleaner energy sources

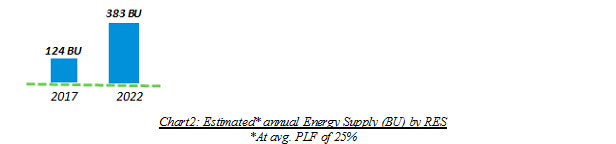

- Accelerated demand for RES technologies and services.

- New business segments to help integrate VRE penetration in grid.

Rising trend of electric mobility

- E-mobility to create additional demand

- Rising trend of EV adoption to boost demand for EV subsystems.

- EV ancillary services such as battery swapping, recycling to receive major boost.

Adoption of electricity for cooking

- Rural sector consumers to increasingly adopt electricity as primary fuel for cooking.

- Major contribution towards base demand.

Drivers of Growth

- Increase in the supply base

- Expansion of transmission network

- Distribution reforms &system strengthening

- Improvement in governance &transparency

- Adoption of emerging trends &technology

The drivers of growth are leading to:

- 24X7 affordable and reliable power

- Increased investment opportunities

Chart 4: Installed RE Capacity

The Investment line-up in the next 5-10 years

- USD 310-350 billion

- 266 GW addition

- 293 global firms

Emerging trends: Indicative Opportunity Sizing

Decentralized Distributed Generation

- High prospects if initiated at the DISCOM level

- In Solar Rooftop, 40 GW capacity addition target by 2022

- INR 23,450 crores central financial assistant for solar roof top installations proposed by MNRE

- States aggregating capacities and inviting bids

Electric Vehicles

- Increase base-load demand, higher PLF

- Effective channel for renewable peak power

- EV Estimates as per report by NitiAyog for 2030

--Business As Usual scenario: 26 million

--Transformative scenario:261 million

Smart Meters

- Installation of 35 million by end of 2019 (envisaged under UDAY).

- EESL procuring 50 lakh smart meters for 2 States through competitive bidding.

Storage

- Estimates on EV battery domestic manufacturing under different stages as per NitiAyog

- Battery pack potential stands at 120 GWh

- End to end manufacturing potential comes to 2410 GWh

Ancillary Services

- High significance with increased VRE

- Total quantum of spinning reserves (primary, secondary and tertiary) is more than 13,500 MW

- Currently,tertiary frequency control

- Going forward, market based ancillaryservice framework

Likely Investment Potential in major segments

- On the Distribution side, new trends and emerging areas like rooftop solar, EVs, smart meter, storage, ancillary services etc. to open additional avenues of investment.

- DISCOM turnaround through UDAY to improve the overall performance of power sector, thereby making it more investment friendly

DISCOM Transformation and Strengthening

UDAY[Ujwal DISCOM Assurance Yojana]

- 24X7 reliable &affordablesupply

- Commercially viable discoms

- Eliminate stress of banking sector from DISCOM exposure

IPDS[Integrated Power Development Scheme]

- An integrated scheme for urban areas with outlay Rs 27,052 crores, targeting

---IT Enablement (Quality and Reliability)

---System strengthening

Achievements under IPDS

- IT enablement completed in 1367 towns; fresh sanctions for 1932 towns amounting to Rs 985 Crores.

- Old system strengthening projects completed in 970 towns; fresh sanctions for 3616 towns.

- Expected to boost industry performance, as IPDS directs interventions in urban areas where most industrial hubs/ centres are located.

Sector Myths

Myth: UDAY is not Performing

Reality:

- UDAY is a 3 year long programme where performance of the States is contingent to the time spent under UDAY, as different states have joined UDAY at different points in time

- Early results under UDAY are encouraging, with some distinct benefits on operations. Going forward, improvement in metering to enhance the performance

- Performance slack in some states may be attributed to interlinked factors like lead time of interventions, data-lag and seasonality of operations etc

Myth: UDAY is not creating demand

Reality:

- UDAY is a supply side intervention which aims to release the latent demand, that exists in the system due to short supply of power to the consumers.

- Under UDAY, total energy billed by DISCOMs increased by 9% in FY17 over FY16, indicating a considerable growth in consumption, which in the past years had grown around 5-6%

Myth: Increase in rural connection under SAUBHAGYA [PradhanMantriSahajBijliHarGharYojana] will result in increase in losses and low cost recovery

Reality:

- SAUBHAGYA scheme would ensure energy access to all households; expected increase in demand of 28 GW

- Increase in demand would lead to lower fixed costs due to higher PLFs

- 100% metering is integral to SAUBHAGYA ensuring theft control and revenue recovery

Above details are for 14 states contributing 95% of the agriculture sales. Percentage of agricultural sales have remained largely in the same range from FY14 to FY16. Therefore, there is no tell-tale sign of losses being loaded on the agricultural category.

UDAY Performance

A total of 19 States have increased their tariff either in FY 16 or FY17. Tariff hikes have resulted in an additional revenue of Rs. 10,009 Cr. in FY 16 and Rs. 20,427 Cr. in FY17.

please contact: contact@energetica-india.net.